Global Financial Crisis 2.0 is Being Used to Consolidate the Banks in Preparation for CBDCs – More Proof from the FRB Collapse

What are we to make of the Daily Sceptic rubbing its hands with glee at the prospect that FRB’s collapse might be reducible to the well-worn ‘get-woke-go-broke’ slogan?

On 1 May 2023, First Republic Bank (FRB) elbowed Silicon Valley Bank (SVB) off its perch as the second largest bank failure in US history. SVB had held that honour for a mere 7 weeks before FRB stole its title. Things are certainly hotting up in the precarious banking sector.

What are we to make of the Daily Sceptic rubbing its hands with glee at the prospect that FRB’s collapse might be reducible to the well-worn ‘get-woke-go-broke’ slogan? First, if ‘get-woke-go-broke’ was a phenomenon to be taken seriously, 75% of businesses currently doing a brisk trade would be, well, broke. It’s simply a fact that you can’t buy anything these days without some disingenuous pledge from the seller that their product or service is ‘eco-friendly’ or ‘carbon-neutral’ or whatever other planet-saving virtue signalling that the vast majority of branch covidians and New Normies need to see before they press click on the buy button.

These businesses aren’t actually doing anything concrete to ‘save the planet’ and they’re certainly not forgoing profit to stop more plastic going into the oceans or halt the extinction of snow leopards and mountain gorillas. They’re just signalling to their customers with a wink and a nudge that they ‘understand’ their obsession with the current thing. It’s nothing more than branding and, as much as I despise wokery, you could argue that get-woke-to-avoid-going-broke is actually a valid business imperative premised on customer loyalty.

In short, pandering to wokery is not a moral decision by businesses; it’s about making sure the tills ring, and they wouldn’t do it if the majority of customers weren’t identikit automatons demanding it.

So why has the Daily Sceptic reduced such a massive and complex economic crisis to the political equivalent of a nursery rhyme? Well, I suspect that on some of the really big issues, like The System, they aren’t sceptics at heart. They’re ideologues. If they were capable of casting their gaze upwards, instead of left and right, they might realise that we are all being pissed on from a dizzy height by a global public-private-partnership desperately trying to preserve the age-old pastime of the parasitic class keeping the serfs in their place. Wokery exists and it is infuriating, but it’s part of a bigger picture. Perhaps their refusal to engage with this bigger picture signifies a belief that this is the way things are meant to be. Perhaps they believe that personal responsibility means jostling for a very limited supply of umbrellas when the masters of the universe decide it’s time to relieve themselves in the direction of the people.

At any rate, let’s examine some facts to see if we can decipher a more credible analysis of the ongoing banking collapse. And right off the bat, I’m going to say that ‘collapse’ is not quite the right word. So far, it’s turning out be more of a consolidation, which is a point I emphasised in my analysis of the SVB collapse, or, should I say, consolidation.

What caused FRB’s demise?

Contrary to spurious claims of woke mismanagement, the Financial Times characterised the failure as “alarming” because FRB “was, on the surface, highly successful and not engaged in obviously risky activities”. Like SVB before it, FRB’s depositors lost confidence and began withdrawing funds at a rate the bank could not cope with. It wasn’t the same sudden drain of £42 billion in a single day that sunk SVB, but rather £100 billion over January to March – a decline in deposits of 41%. FRB took out loans from the Federal Home Loan Bank Board (FHLB) and Federal Reserve, in addition to borrowing $30 billion from a consortium of 11 banks in an attempt to staunch the liquidity crisis. In the end it wasn’t enough. It had to throw in the towel, at which point JP Morgan was invited to absorb it into its operations.

So, what caused FRB’s depositors to lose confidence? Again, like SVB, most of FRB’s deposits (67%) were in excess of the insured limit of $250,000. And why was that? Well again like SVB, FRB’s depositor profile was heavily weighted towards very wealthy depositors. That’s because FRB’s business model focussed on high net-worth clients. These high net-worth clients with deposits in excess of the $250k insured amount decided to limit their exposure by distributing their deposits with other banks. They needn’t have worried, though, because when the FDIC called time on FRB, the rescue plan mitigated all losses to depositors, just as it had done with SVB. So no-one got hurt, which so far seems to be the rule when it comes to failing banks with wealthy depositors. It will be interesting to see how the FDIC and the Fed handle a teetering bank that isn’t so beholden to the great and the good.

But it wasn’t simply jittery depositors that sent FRB tumbling. The bank got caught holding low-yield assets that took the shine off its profitability in a high interest rate environment. Its lacklustre portfolio of real estate loans and municipal securities squeezed the margin between the interest it was earning on these assets and the higher interest rates customers were demanding to leave their deposits with FRB. It would probably have survived that if it hadn’t been for the depositor run on the bank, but it emphasises the point I highlighted in my earlier analysis – why is the Fed provoking a liquidity crisis by hiking interest rates and increasing pressure on bank margins and capital? Two days after FRB was sold to JP Morgan, the US Fed raised interest rates yet again.

Thomas J. Hayes, Chairman and Managing Member, Great Hill Capital didn’t mince his words:

"When it was just SVB, it was easy to blame management. However, now that we see the pattern, it is evident that the Fed has moved too far, too fast and is breaking things."

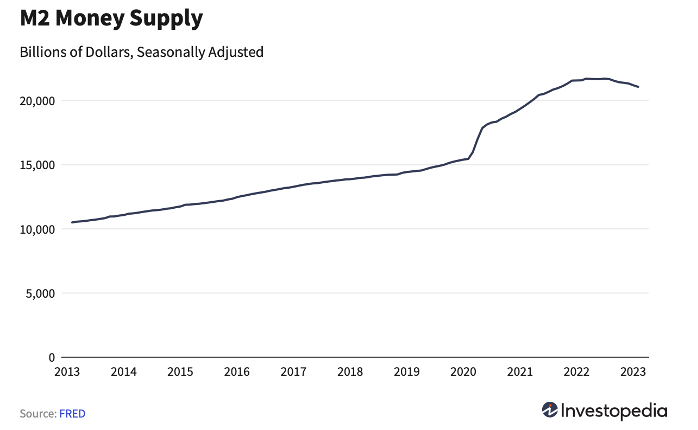

Attempting to use the interest rate lever on inflation caused by money printing on the scale that has taken place since the casino phase of banking took off in the 1990s is completely futile, and the geniuses at the Fed, and every other central bank, know it. The US M2 money supply rose from $15.4 trillion in February 2020 to $21 trillion in February 2023:

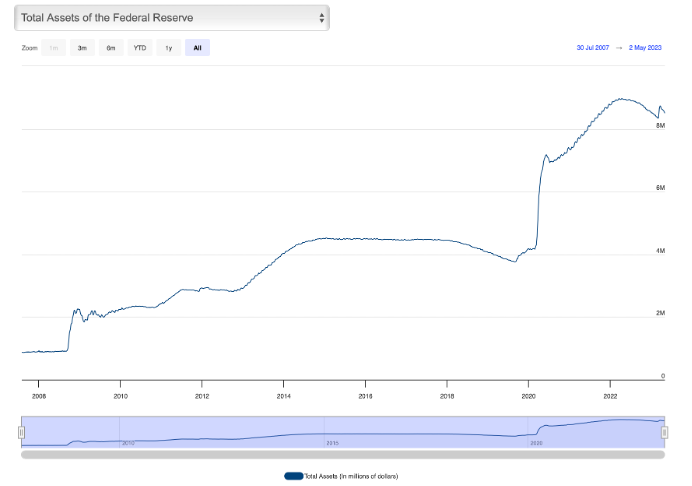

This growth correlates with the Federal Reserve money printing mania. The US Federal Reserve’s balance sheet stood at $0.9 trillion in 2007 and grew to $4.1 trillion in February 2020 – an increase of 355%. From there, it doubled in three years to $8.3 trillion by the end of February 2023. That increase was the direct result of its monetary expansion policy.

Hyper-inflation is the inevitable consequence, and the off-ramp that the Fed seems to want to take is an implosion in economic activity and debt on the scale of another Great Depression. I think that’s where we’re headed, and that isn’t a ‘mistake’ on the part of the masters of the universe.

And while we’re on the subject of economic ‘mistakes’, we need to disabuse ourselves of the quaint notion that the financial powers pressed pause on the global economy and printed oceans of money over the last three years as an economic stimulus response to the equivalent of a seasonal flu outbreak. The colossal scale of the lies and propaganda, the corruption of science, the industrial scale censorship, the suppression of dissent, the destruction of lives and economies through global lockdowns, the brutal erosion of civil and human rights to force an experimental injection on the entire globe – this was not a ‘misguided’ response to a patently overhyped viral threat, known to be overhyped at the outset. It was in fact the most audacious psychological operation ever undertaken in history. And it was engineered by a psychopathic parasitic class to control the collapse of an unsustainable economic system.

The phoenix they yearn to see rising from the ashes of this atrocity is a system of financial and social control from which it will be impossible for ordinary people to escape. Hence the unrelenting push towards digital ID systems, Central Bank Digital Currencies, and legislation for greater censorship under the guise of curbing misinformation and disinformation, the greatest propagators of which are the Government itself and the mainstream media.

Thus, one of the primary purposes (certainly not the only one) of the manufactured ‘pandemic crisis’ was to provide cover for the money printing operation, and act as an economic dampener (lockdowns) for that printing spree which was desperately needed to plug new holes in bank liquidity that had re-emerged since the 2008 Global Financial Crisis.

A pattern is emerging – more consolidation and too-big-to-fail banks are being made bigger

JP Morgan already held a whopping 10% of total US banking deposits before it swooped in on FRB. After acquiring FRB, its deposits will increase by another 3%. The FT doesn’t seem to be able to make up its mind about whether this is a good thing or not. On the one hand, it backs the consolidation drive by stating that “America has too many banks and consolidation is needed”. On the other hand, it coyly acknowledges that JP Morgan’s acquisition of FRB “could both be detrimental to competition and makes it even more of a too-big-to-fail institution”. JP Morgan was technically ineligible to acquire FRB owing to its already outsized share of total banking deposits, but the rule book was thrown out of the window to allow a too-big-to-fail bank to get even bigger.

When the FT is done paying lip service to competition and pretending to care about the dangers of too-big-to-fail banks, it knows, as do most of us with eyes to see, that consolidation is part of the overall central bank strategy for a controlled demolition of the ponzi scheme and delivering us into the hellscape of CBDCs. Far fewer banks is a prerequisite for administration of the desired hyper-centralised CBDC system, making the roll-out and administration of CBDCs much easier while providing a tighter noose for consumers.

By the time you read this piece, it’s likely that a couple more banks will be getting added to the banking consolidation party as PacWest and Western Alliance are on the brink of collapse and rumoured to be seeking strategic acquisitions.

As with the previous failures in March, the losses on the stressed assets of the failed banks are being rinsed through the FDIC while the acquiring bank absorbs the non-toxic assets. Parking the FRB’s dodgy loan book with the FDIC will cost the banking sector and ultimately the consumer £13 billion – the FDIC’s insurance premiums will cover it but those increased costs to banks will be recovered from consumers in one way or another. The only difference between this approach and the 2009 taxpayer bail-out is that this time, the consumer is presented with the bill by the banks themselves instead of through the government. The banking mafia understands that attempting a replay of the 2009 taxpayer bailout would make it harder to get the public to swallow the bitter pills that are coming with the collapse, one of which is CBDCs. It’s fear that will make the medicine go down, not anger.

To that end, it is only a matter of time before bank collapses are used to sow real panic as opposed to asset consolidations and controlled detonations of bad debt. It is only a matter of time before the banking collapse is weaponised by the banking cartel to hurt people who they think can’t fight back – the people they want to control with CBDCs.